A recent survey of human resources leaders and “return-to-workplace-decision makers” across multiple industries indicates most companies will adopt a home-office, or hybrid mix when it is time to return to the workplace, with three-fourths of respondents expecting employees to spend two to three days per week in the office.

The flexibility of the post-Covid-19 hybrid workplace presents families with a childcare dilemma that many will resolve by hiring a live-out or live-in nanny. According to Jenna Shklyar, Head of Marketing at SurePayroll, hiring a nanny to supplement and simplify childcare also adds the responsibility of household payroll and tax consequences.

“Parents who hire a nanny for the summer need to consider payroll and tax responsibilities, like those of a small business owner. A nanny is more than a casual babysitter in the eyes of the federal government,” said Shklyar. “Live-out or live-in childcare is considered a household employee, a classification with specific rules and requirements.”

Jamal Ayyad, Head of Product Management at SurePayroll, acknowledges most families invest tremendous time and energy determining qualifications, likeability, personality, discipline style, and general family fit. He suggests they also fully understand their obligation as a household employer to “avoid costly problems, penalties and fines” and benefit from government programs. “Families can save money by paying their nanny on the books, thanks in part to the Dependent Care FSA, which is up to $10,500 in 2021.”

Ayyad encourages parents follow these tips from SurePayroll as they consider hiring a summer or return-to-workplace nanny:

- Appropriate Pay Rate. The national average pay for a nanny is roughly $26 per hour, depending on geography, number and age of children, and additional responsibilities, such as school and activity transportation, meal preparation, tutoring and more. A nanny is entitled to being paid time and a half for overtime work, and more.

- Job Classification. It is critical not to classify a nanny as an independent contractor or consider a nanny as self-employed, and it is improper to issue a Form 1099 to a nanny who earned $2,300 or more in 2021.

- Failure to properly classify a household employee can lead to serious tax consequences, including tax evasion charges and penalties that could exceed $25,000.

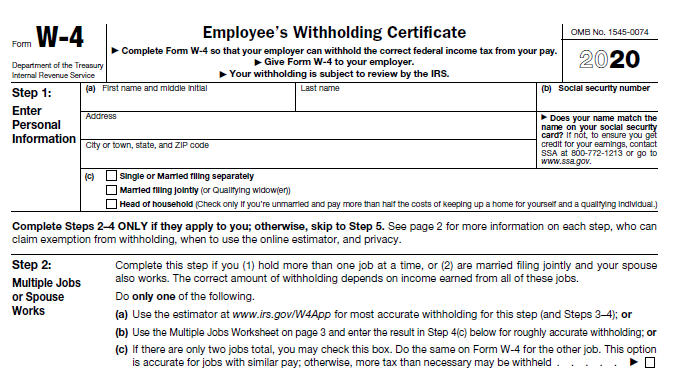

- Online Payroll System. A household employer is responsible for managing payroll, including withholding taxes; paying a nanny “under the table” is not a viable option. That’s why many families opt to use an online payroll system that calculates and pays the necessary taxes and files the appropriate deductions for Social Security, Medicare, unemployment, and state taxes. SurePayroll Household and Nanny Payroll Service also prepares multiple 1040-ES filings on behalf of the household employer and provides a signature-ready Schedule H to attach to the client’s annual 1040 filing.

- Homeowners Insurance. It is vital household employers verify their existing homeowner’s policy covers property damage, personal liability, and potential injuries. Household employers may need to update their policy or add insurance riders to cover nanny services. This is especially important since each state has different rules and requirements regarding household employee coverage based on live-in and / or hours worked. Some states do not consider homeowners insurance as valid workers’ compensation coverage for household employees. Be sure to check with a local agent to ensure coverage compliance.

Hiring a nanny can offer parents peace of mind as they transition back to in-office work this summer. But making a mistake in the employment process can turn be costly.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs